HEDGE FUNDS

Achieve more, with far less overhead.

Launching a new fund?

We can helpLandscape

Address complexity at its source.

Hedge fund managers remain under intense pressure to achieve and maintain peak performance. The rise of passives, ongoing fee pressure, and regulatory uncertainty make it more vital than ever to consistently demonstrate the transparency and returns investors demand. And launching a new fund can complicate matters even further.

The problem is technology. No matter what change you need to make in strategy, region, or asset class, legacy systems are too often the reason why it can’t happen as rapidly as needed. And augmenting, patching, or replacing the technology itself only brings more headaches.

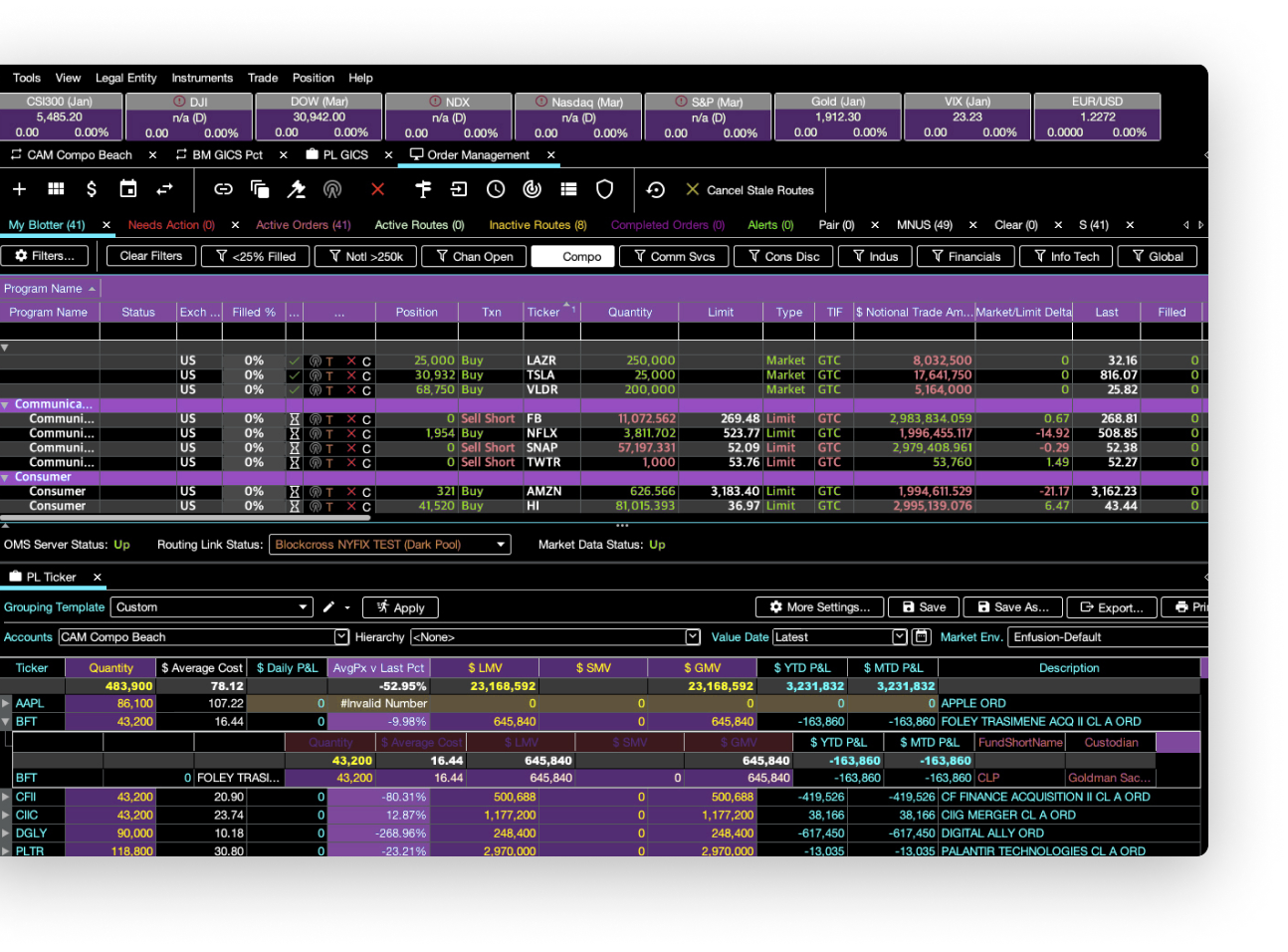

How can you break the cycle of perpetually investing in systems that fall short? Choose the only framework that is fundamentally different in how it was built, what it can do, and how it can evolve. From its centrally managed security master (with automatic handling for corporate actions) to its native support for fixed income, alternatives, and complex derivatives, Enfusion has you covered.

Download the brochure:

- For Multi-Strategy Hedge Funds

- For Equity Hedge Funds

- For Global Macro Hedge Funds

Follow your investment thesis wherever it takes you.

Challenge

How Enfusion Can Help

Challenge

New features are only available through time-consuming upgrades.

How Enfusion Can Help

Cloud-native SaaS model.

Challenge

Existing systems don’t support workflows for new markets and asset types.

How Enfusion Can Help

Zero-footprint, turnkey F2B solution.

Challenge

Security master data is difficult to reconcile across stitched-together application stacks.

How Enfusion Can Help

Pre-populated security master

Challenge

Need to integrate new solutions into existing systems.

How Enfusion Can Help

A proven record.

Challenge

Workflows are disjointed and require high manual effort.

How Enfusion Can Help

Streamline workflows and boost productivity.

Challenge

High IT infrastructure costs.

How Enfusion Can Help

Single source of truth across the firm.

Case Study: Ghost Tree

Overcoming legacy tech to spur growth

Case Study: Castle Knight

Enfusion helps CastleKnight launch with multiple asset classes

Case Study: Albany Capital

Streamlining fund ops to meet evolving strategy needs

Statistics

Strength in numbers.

9

OFFICES ACROSS FIVE CONTINENTS

18

YEARS OF CLOUD-NATIVE SAAS

775+

Implementations